Indexed

Universal Life

Insurance

Financial Freedom 817

Planning for the future can be daunting, but protecting your family’s financial security doesn’t have to be. IUL Insurance provides peace of mind by offering lifelong coverage and potential cash value growth, ensuring that your loved ones are protected while you build a flexible financial safety net.

Kurtis

⭐⭐⭐⭐⭐

"Working with Shasikala has been a game-changer for my financial future. They took the time to understand my goals and provided clear, practical advice that made a real difference. Thanks to their guidance, I feel more confident about my investments and long-term planning. I highly recommend their services to anyone looking for honest and personalized financial advice."

Happy Customers

More than 25 clients taken care of!

Indexed Universal Life Insurance

Financial Freedom 817

Planning for the future can be daunting, but protecting your family’s financial security doesn’t have to be. IUL Insurance provides peace of mind by offering lifelong coverage and potential cash value growth, ensuring that your loved ones are protected while you build a flexible financial safety net.

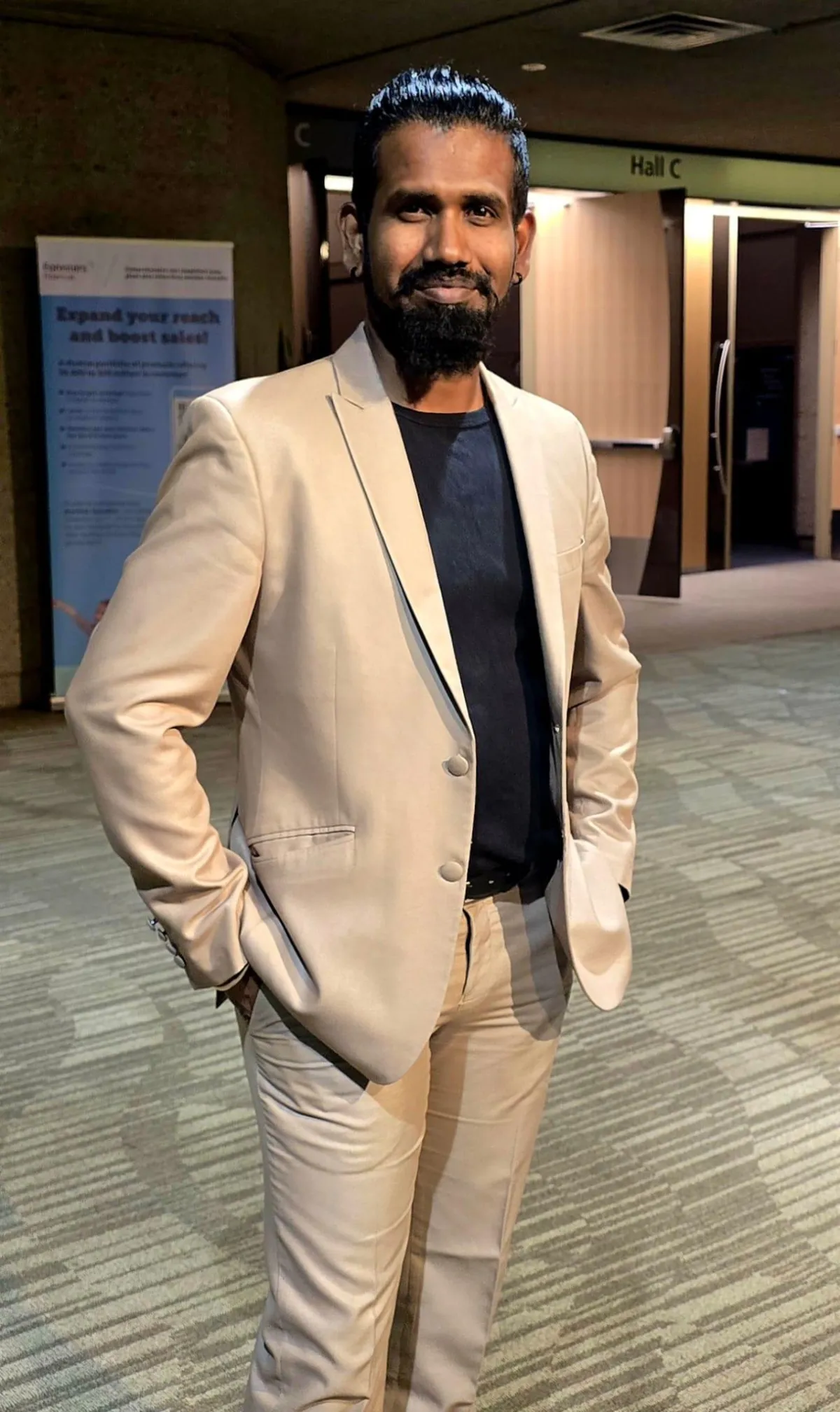

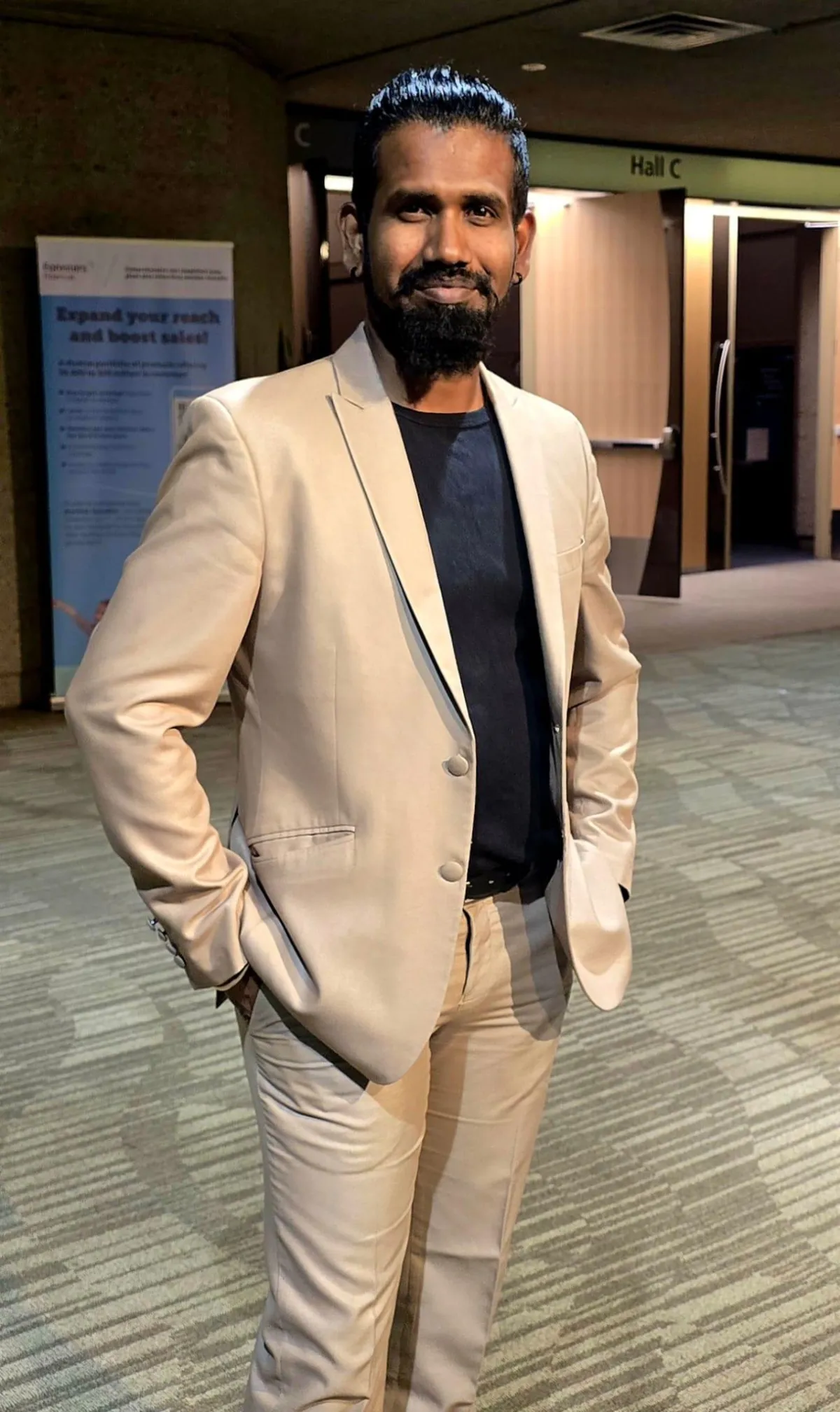

About Us

Helping You To

Manage Your IUL

Insurance Needs!

A dedicated financial Security advisor helping individuals and families make smart financial decisions. Specializing in budgeting, retirement planning, investments, and protections with a personalized, client-first approach. Committed to building long-term financial security and peace of mind.

Ilanjezhian Tamizharasan

Individual Financial Security advisor

NPN:

About Us

Helping You To

Manage Your IUL Insurance Needs!

A dedicated financial Security advisor helping individuals and families make smart financial decisions. Specializing in budgeting, retirement planning, investments, and protections with a personalized, client-first approach. Committed to building long-term financial security and peace of mind.

Ilanjezhian Tamizharasan

Individual Financial Security advisor

Everything You Need To Know

About IUL Insurance

At A Glance

What is Indexed Universal Life Insurance?

IUL Insurance provides lifelong coverage with cash value growth tied to market performance, allowing you to protect your family and build savings with flexible premiums.

Important Details

IUL offers coverage while accumulating cash value, which can be accessed for retirement, emergencies, or other needs. It’s a flexible plan for long-term financial security.

Everything You Need To Know About

IUL Insurance At A Glance

What is Indexed Universal Life Insurance?

IUL Insurance provides lifelong coverage with cash value growth tied to market performance, allowing you to protect your family and build savings with flexible premiums.

Important Details

IUL offers coverage while accumulating cash value, which can be accessed for retirement, emergencies, or other needs. It’s a flexible plan for long-term financial security.

Reviews

Real-Life Testimonials

From Satisfied Clients

Kurtis

"Working with Shasikala has been a game-changer for my financial future. They took the time to understand my goals and provided clear, practical advice that made a real difference. Thanks to their guidance, I feel more confident about my investments and long-term planning. I highly recommend their services to anyone looking for honest and personalized financial advice."

Sham

I can’t thank Ilan enough for their support and guidance. As someone who was overwhelmed with managing my finances, he made everything clear and easy to understand. From budgeting and saving to planning for retirement, Ilan provided thoughtful, tailored advice every step of the way. I now feel more in control of my financial future and truly appreciate the professionalism and care they bring to their work.

Paul

"Working with Shasikala on setting up an RESP for our children was one of the best financial decisions we’ve made. She walked us through the process step by step, explained the government grants available, and helped us choose the right investment options based on our goals. Thanks to Shasi guidance, we now feel confident that we’re building a strong foundation for our kids’ education. Highly recommend Shasikala to any parent looking to start an RESP!"

Reviews

Real-Life Testimonials

From Satisfied Clients

Kurtis

""Working with Shasikala has been a game-changer for my financial future. They took the time to understand my goals and provided clear, practical advice that made a real difference. Thanks to their guidance, I feel more confident about my investments and long-term planning. I highly recommend their services to anyone looking for honest and personalized financial advice.""

Sham

"I can’t thank Ilan enough for their support and guidance. As someone who was overwhelmed with managing my finances, he made everything clear and easy to understand. From budgeting and saving to planning for retirement, Ilan provided thoughtful, tailored advice every step of the way. I now feel more in control of my financial future and truly appreciate the professionalism and care they bring to their work."

Paul

""Working with Shasikala on setting up an RESP for our children was one of the best financial decisions we’ve made. She walked us through the process step by step, explained the government grants available, and helped us choose the right investment options based on our goals. Thanks to Shasi guidance, we now feel confident that we’re building a strong foundation for our kids’ education. Highly recommend Shasikala to any parent looking to start an RESP!""

More Info

Important Questions

Is Indexed Universal Life Insurance Right for Me?

IUL Insurance is ideal if you want lifelong coverage with the potential for cash value growth. It’s a flexible option that lets you adjust your premiums and death benefit, making it suitable for those who want both protection and a financial growth opportunity.

How Much Coverage Do I Need?

The amount of coverage depends on your financial goals and the needs of your beneficiaries. IUL policies can be customized, allowing you to choose a coverage amount that provides security for your family while meeting your budget.

Is a Medical Exam Required?

In many cases, a medical exam may be required for IUL Insurance, especially if you're looking for higher coverage amounts. However, some policies may offer simplified underwriting for lower coverage limits.

Can I Access the Cash Value?

Yes, you can access the cash value accumulated in your IUL policy. It can be used for various financial needs, such as supplementing retirement income, covering unexpected expenses, or funding education.

How do I Sign Up?

You can start by scheduling a consultation to discuss your needs with an insurance expert. They’ll help you customize your IUL policy and guide you through the application process.

More Info

Important Questions

Is Indexed Universal Life Insurance Right for Me?

IUL Insurance is ideal if you want lifelong coverage with the potential for cash value growth. It’s a flexible option that lets you adjust your premiums and death benefit, making it suitable for those who want both protection and a financial growth opportunity.

How Much Coverage Do I Need?

The amount of coverage depends on your financial goals and the needs of your beneficiaries. IUL policies can be customized, allowing you to choose a coverage amount that provides security for your family while meeting your budget.

Is a Medical Exam Required?

In many cases, a medical exam may be required for IUL Insurance, especially if you're looking for higher coverage amounts. However, some policies may offer simplified underwriting for lower coverage limits.

Can I Access the Cash Value?

Yes, you can access the cash value accumulated in your IUL policy. It can be used for various financial needs, such as supplementing retirement income, covering unexpected expenses, or funding education.

How do I Sign Up?

You can start by scheduling a consultation to discuss your needs with an insurance expert. They’ll help you customize your IUL policy and guide you through the application process.

Looking for a First-Class IUL Insurance Consultant?

Looking for a First-Class IUL Insurance Consultant?

Financial Freedom 817 is committed to serving you at the highest level with all your Indexed Universal Life Insurance needs.

National Producer Number:

Company

Directories

Legal

Financial Freedom 817 is committed to serving you at the highest level with all your Indexed Universal Life Insurance needs.

National Producer Number:

Company

Directories

Legal